First-Year Workers Account for Over a Third of Work-Related Injuries: Insights from the 2024 Injury Impact Report

A recent report by The Travelers Cos. highlights a concerning trend in workplace safety: more than a third of work-related injuries occur during employees’ first year on the job. This statistic is based on data from over 1.2 million workers’ compensation claims submitted between 2017 and 2021, providing a comprehensive look at the state of workplace injuries across various industries.

Key Findings from the 2024 Injury Impact Report:

- First-Year Workers Are at High Risk:

- Employees in their first year on the job accounted for 35% of all workers’ compensation claims.

- These injuries resulted in more than 6 million missed workdays, underscoring the significant impact on both workers and businesses.

- High Average of Missed Workdays:

- On average, workers who were injured missed 79 days of work.

- The construction industry had the highest average number of missed workdays per claim, with an average of 103 days.

- Transportation followed with an average of 83 missed workdays per claim.

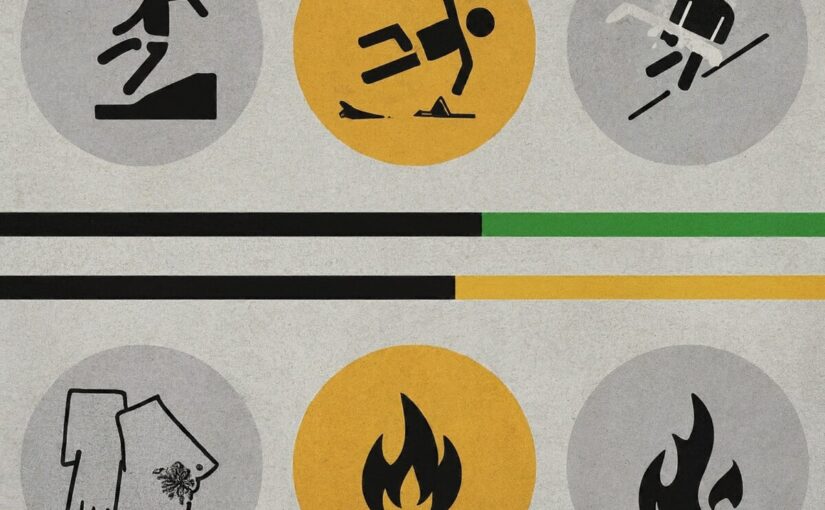

- Leading Causes of Workplace Injuries:

- Overexertion accounted for 29% of the claims, including injuries from lifting, twisting, pulling, or pushing.

- Slips, trips, and falls were the second most common cause, representing 23% of claims.

- Struck by an object incidents made up 12% of the claims.

- Motor vehicle-related incidents and caught in/between hazards each accounted for 5% of the claims.

Contributing Factors and Industry Impact:

- Inexperience and Workforce Shortages:

- The high injury rate among first-year workers is partly due to inexperience. New employees may not be fully aware of workplace hazards or may not have received adequate safety training.

- Workforce shortages also play a role, as overworked or undertrained employees are more likely to make mistakes that lead to injuries.

- Maintenance and Safety Issues:

- Poor maintenance and inadequate safety protocols contribute to the high number of injuries. Companies that neglect equipment maintenance or fail to enforce safety standards put their employees at greater risk.

The Importance of Workplace Safety Investments:

Despite a downward trend in the overall number of injuries in recent years, the data indicates a pressing need for improved safety measures, particularly for new hires.

By addressing the risks faced by first-year employees, businesses can reduce the number of injuries and associated missed workdays, ultimately benefiting both employees and the bottom line.

Workers Comp Resources

Need Legal Help ?

844–682‑0999

#BackToWorkAfterInjury #ClaimsDenied #ConstructionWorkersCompensation #DeathBenefits #Employers #FloridaWorkersCompBenefits #IndependentContractors #InjuredAtWork #LawsIn50States #Lawyer #MedicalBenefits #OregonWorkersCompBenefits #OSHA #RehireAfterInjury #USDepartmentOfLabor #WorkersCompBenefits #WorkersCompClaims #WorkersCompensationLaws #WorkersCompRights #WorkInjuryTerms